A securities class action has been filed against Block, Inc. (SQ) on behalf of all purchasers of Block Class A common stock between February 26, 2020 through April 30, 2024. This case has been filed in the USDC – NDCA.

The complaint alleges that During the Class Period, defendants claimed that Block maintained robust anti-money laundering (“AML”) and other compliance protocols and procedures designed to effectively prevent the use of the Company’s products and services from being used for illicit or criminal activities. For example, in periodic SEC filings, defendants represented that the Company had “implemented an AML program designed to prevent our payments network from being used to facilitate money laundering, terrorist financing, and other illicit activity.” Defendants further stated that this compliance program was “designed to prevent [Block’s] network from being used to facilitate business in countries, or with persons or entities, included on designated lists promulgated by the U.S. Department of the Treasury’s Office of Foreign Assets Controls and equivalent applicable foreign authorities.” Defendants highlighted Block’s “policies, procedures, reporting protocols, and internal controls, including the designation of an AML compliance officer” and its purported “vet[ting] and monitor[ing]” of Block’s customers and the transactions on Block’s platforms, which defendants claimed addressed the Company’s “legal and regulatory requirements and [were designed] to assist in managing risk associated with money laundering and terrorist financing.”

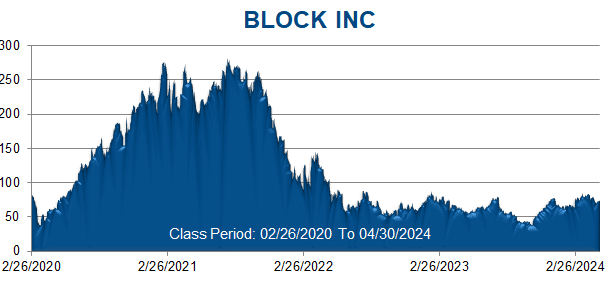

As a result of defendants’ wrongful acts and omissions, and the subsequent declines in the market value of Block Class A common stock, which dropped 77% to a low of less than $66 per share by Class Period end from its Class Period peak of over $289 per share, plaintiff and other members of the Class (defined below) suffered significant financial losses and economic damages under the federal securities laws.