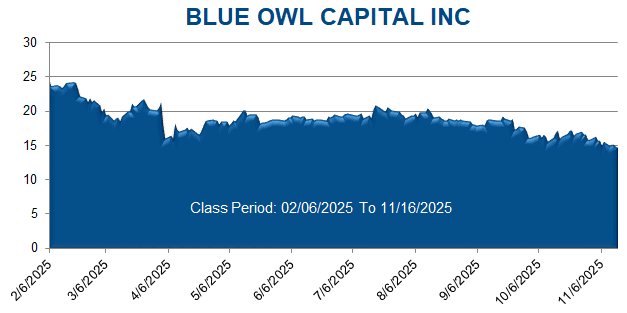

A securities class action has been filed against Blue Owl Capital Inc. (OWL) on behalf of persons and entities that purchased or otherwise acquired Blue Owl securities between February 6, 2025 through November 16, 2025. This case has been filed in the USDC – SDNY.

Blue Owl is an asset management firm which specializes in alternative investment solutions, primarily private credit (also called “direct lending”). It has three major product platforms: Credit, GP Strategic Capital, and Real Assets. Within Credit, Blue Owl offers direct lending, alternative credit, investment grade credit, liquid credit, and other private financing solutions. As of fiscal 2024, Blue Owl had over $251 billion in assets under its management, 40% of which was part of the Company’s Direct Lending business.

The complaint alleges that throughout the Class Period, Defendants made materially false and/or misleading statements, as well as failed to disclose material adverse facts about the Company’s business, operations, and prospects. Specifically, Defendants failed to disclose to investors: (1) that Blue Owl was experiencing a meaningful pressure on its asset base from BDC redemptions; (2) that, as a result, the Company was facing undisclosed liquidity issues; (3) that, as a result, the Company would be likely to limit or halt redemptions of certain BDCs; and (4) that, as a result of the foregoing, Defendants’ positive statements about the Company’s business, operations, and prospects were materially misleading and/or lacked a reasonable basis.