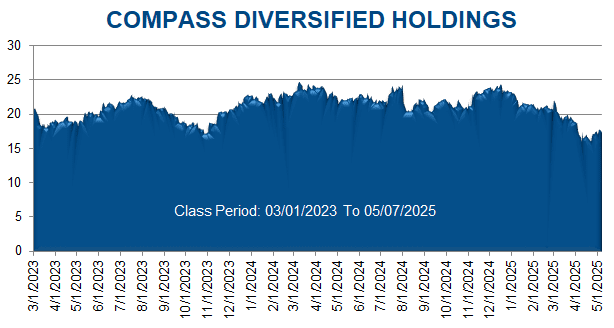

Scott+Scott Attorneys at Law LLP (“Scott+Scott”), an international shareholder and consumer rights litigation firm, has filed a securities class action lawsuit in the United States District Court for the Central District of California against Compass Diversified Holdings (“Compass” or the “Company”) (NYSE: CODI), and certain of its former and current officers and/or directors (collectively, “Defendants”). The Class Action asserts claims under §§10(b) and 20(a) of the Securities Exchange Act of 1934 (15 U.S.C. §§78j(b) and 78t(a)) and U.S. Securities and Exchange Commission Rule 10b-5 promulgated thereunder (17 C.F.R. §240.10b 5) on behalf of all persons other than Defendants who purchased or otherwise acquired Compass securities between March 1, 2023 and May 7, 2025, inclusive (the “Class Period”), and were damaged thereby (the “Class”). The Class Action filed by Scott+Scott is captioned: Kevin Tan. v. Compass Diversified Holdings, et al., Case No. 2:25-cv-5777.

Compass owns and manages a diverse set of middle-market businesses, including Lugano Holdings, Inc. (“Lugano”), which designs, manufacturers, and markets luxury jewelry.

The Class Action alleges that, during the Class Period, Defendants made misleading statements and omissions regarding the Company’s business, financial condition, and prospects. Specifically, Defendants failed to warn investors and consumers that: (1) Defendants knew (or recklessly disregarded) that Compass’s internal control over financial reporting was patently defective, resulting in the issuance of financial statements that contained material errors; (2) Lugano had violated applicable accounting rules and acceptable industry practices with respect to its financing, accounting, and inventory practices during the Company’s 2022-2024 fiscal years; (3) Lugano’s 2022-2024 financial results had been artificially distorted by these irregularities; (4) Compass had failed to implement effective internal controls over the Company’s financial reporting; and (5) as a result of (1)-(4) above, Compass’s reported 2022-2024 financial results did not reflect the actual financial results of the Company and such reported results were materially misstated.

The market began to learn the truth on May 7, 2025, after market hours, when the Company issued a press release disclaiming “reliance on its financial statements for fiscal 2024 amid an ongoing internal investigation” into Lugano, and that the Company intends to delay the filing of its 1Q25 Form 10-Q. The press release also revealed that an ongoing investigation, led by outside counsel and a forensic accounting firm, “preliminarily identified irregularities in Lugano’s [non-Compass] financing, accounting, and inventory practices.” Lugano’s founder and Chief Executive Officer resigned following the disclosure of the investigation’s preliminary findings. On this news, the price of the Company’s stock fell $10.70, or nearly 62%, to close at $6.55 on May 8, 2025, on unusually high volume.

If you purchased Compass securities during the Class Period and were damaged thereby, you are a member of the “Class” and may be able to seek appointment as lead plaintiff.

If you wish to apply to be lead plaintiff, a motion on your behalf must be filed with the U.S. District Court for the Central District of California no later than July 8, 2025. The lead plaintiff is a court-appointed representative for absent class members of the Class. You do not need to seek appointment as lead plaintiff to share in any Class recovery in the Class Action. If you are a Class member and there is a recovery for the Class, you can share in that recovery as an absent Class member.

If you wish to apply to be lead plaintiff, please contact attorney Nicholas Bruno at (888) 398-9312 or at [email protected].