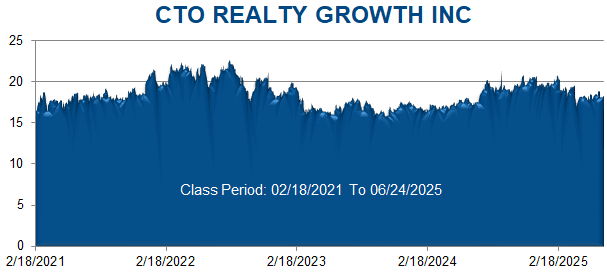

A securities class action has been filed against CTO Realty Growth, Inc. (CTO) on behalf of a class consisting of all persons and entities other than Defendants that purchased or otherwise acquired CTO securities between February 18, 2021 through June 24, 2025. This case has been filed in the USDC – MDFL.

CTO is a publicly traded real estate investment trust (“REIT”) that owns and operates a portfolio of purported high-quality, retail-based properties located primarily in higher growth markets in the United States (“U.S.”). The Company converted into a REIT in February 2021 and, as of December 31, 2024, owned 23 income properties in seven states, including Ashford Lane, a retail and dining center in Atlanta, Georgia.

Under guidelines established by the U.S. Securities and Exchange Commission (“SEC”), REITs must pay out at least 90% of their taxable profits to shareholders annually as dividends. In return, REIT companies are exempt from most corporate income tax. CTO has touted that its operation as a REIT “provides the tax-efficient organizational structure for [its] stockholders” that “will allow [it] to provide them with an attractive and sustainable dividend.”

To measure its performance, CTO uses the financial metric Adjusted Funds from Operations (“AFFO”). The AFFO of a REIT, though subject to varying methods of computation, is generally equal to the REIT’s funds from operations with adjustments made for recurring capital expenditures (also referred to as “capex”) used to maintain the quality of the REIT’s underlying assets. Professional analysts tend to prefer AFFO because it takes into consideration additional costs incurred by the REIT as well as additional income sources, such as rent increases. Thus, analysts believe that AFFO provides for a more accurate base number when estimating present values and a better predictor of the REIT’s future ability to pay dividends.

The Complaint alleges that, throughout the Class Period, Defendants made materially false and misleading statements regarding the Company’s business, operations, and compliance policies. Specifically, Defendants made false and/or misleading statements and/or failed to disclose that: (i) CTO’s dividends were less sustainable than Defendants had led investors to believe; (ii) the Company used deceptive and unsustainable practices to artificially inflate its AFFO and overstate the true profitability of its Ashford Lane property; (iii) accordingly, CTO’s business and/or financial prospects were overstated; and (iv) as a result, Defendants’ public statements were materially false and misleading at all relevant times.

On June 25, 2025, Wolfpack Research (“Wolfpack”) published a report entitled “CTO: The B. Riley of REITs” (the “Wolfpack Report” or the “Report”), which compared CTO unfavorably to B. Riley, a financial services company that recently lost more than 90% of its value amid three years of losses, soured investments, delayed financial reports and revelations that the SEC had been investigating whether the firm gave shareholders an accurate picture of its health. Citing interviews with former employees and whistleblowers, the Wolfpack Report accused CTO of, among other things, “not generating enough cash to pay its recurring capex and cover its dividends since converting to a REIT in 2021” and instead “relying on dilution (increasing shares outstanding by 70% since December 2022) to cover a $38 million dividend shortfall from 2021 to 2024,” employing a “manipulative definition of [AFFO] where they exclude recurring capex, unlike all of their self-identified shopping center REIT peers,” and “using a sham loan to hide the collapse of a top tenant from shareholders at Ashford Lane.” (Emphasis in original).Further, Wolfpack predicted imminent further dilution of the Company, noting that CTO has just $8.4 million in cash while facing quarterly dividends of $14 million and average recurring capital expenditures of $5.7 million per quarter, along with approximately $12 million in additional planned capital expenditures.

On this news, CTO’s stock price fell $0.98 per share, or 5.42%, to close at $17.10 per share on June 25, 2025.