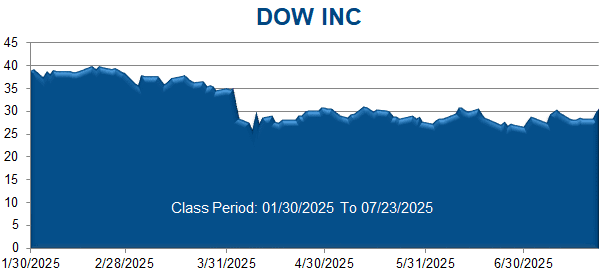

A securities class action has been filed against Dow Inc. (DOW) on behalf of a class consisting of all persons and entities other than Defendants that purchased or otherwise acquired Dow securities between January 30, 2025 through July 23, 2025. This case has been filed in the USDC – EDMI.

On July 24, 2025, Dow issued a press release reporting its financial results for the second quarter of 2025. Among other items, Dow reported that “[n]et sales were $10.1 billion, down 7% year-over-year, reflecting declines in all operating segments. Sequentially, net sales were down 3%, as seasonally higher demand in Performance Materials & Coatings was more than offset by declines across the other operating segments.” Dow’s Chief Executive Officer said that “[w]e are also adjusting our dividend to ensure we maintain a balanced capital allocation framework.”

On this news, Dow’s stock price fell $5.30 per share, or 17.45%, to close at $25.07 per share on July 24, 2025.

The compalint alleges that throughout the Class Period, Defendants made materially false and misleading statements regarding Dow’s business, operations, and prospects. Specifically, Defendants made false and/or misleading statements and/or failed to disclose that: (i) Dow’s ability to mitigate macroeconomic and tariff-related headwinds, as well as to maintain the financial flexibility needed to support its lucrative dividend, was overstated; (ii) the true scope and severity of the foregoing headwinds’ negative impacts on Dow’s business and financial condition was understated, particularly with respect to competitive and pricing pressures, softening global sales and demand for the Company’s products, and an oversupply of products in the Company’s global markets; and (iii) as a result, Defendants’ public statements were materially false and misleading at all relevant times.