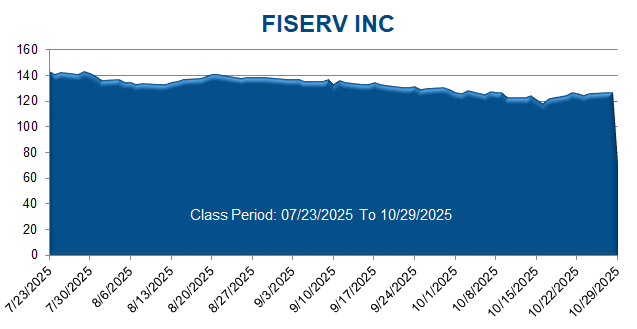

Scott+Scott Attorneys at Law LLP (“Scott+Scott”), an international shareholder and consumer rights litigation firm, has filed a securities class action lawsuit in the United States District Court for the Eastern District of Wisconsin against Fiserv, Inc. (“Fiserv” or the “Company”) (NYSE: FI), and certain of its directors and officers (collectively, “Defendants”). The Class Action asserts claims under §§10(b) and 20(a) of the Securities Exchange Act of 1934 (15 U.S.C. §§78j(b) and 78t(a)) and U.S. Securities and Exchange Commission Rule 10b-5 promulgated thereunder (17 C.F.R. §240.10b‑5) on behalf of all persons and entities other than Defendants who purchased or otherwise acquired Fiserv securities between July 23, 2025 and October 29, 2025, inclusive (the “Class Period”), and were damaged thereby (the “Class”). The Class Action filed by Scott+Scott is captioned: Cypanga Sicav SIF v. Fiserv, Inc., et al., Case No. 2:25-cv-01716.

Fiserv is a Milwaukee, Wisconsin-based global payments and financial technology provider.

The Class Action alleges that, during the Class Period, Defendants made misleading statements and omissions regarding the Company’s initiatives and projects. In July 2025, Fiserv revised its 2025 guidance. Fiserv told the market that its guidance changes were based on a review, termed a “re-underwrit[ing],” of the Company’s new initiatives and products. The Company told investors that although certain of those initiatives and projects were delayed, they were fundamentally sound.

Unbeknownst to investors, Fiserv’s representations to the market in July 2025 were false and misleading. As Fiserv would later admit in October 2025, the Company’s 2025 guidance disclosed in July 2025 was based on “assumptions . . . which would have been objectively difficult to achieve even with the right investment and strong execution.”

Defendants’ materially false and misleading statements during the Class Period resulted in members of the Class purchasing or otherwise acquiring the Company’s securities at artificially inflated prices, thus causing damages when the truth was revealed.

f you purchased or otherwise acquired Fiserv securities during the Class Period, and were damaged thereby, you are a member of the “Class” and may be able to seek appointment as lead plaintiff.

If you wish to apply to be lead plaintiff, a motion on your behalf must be filed with the U.S. District Court for the Eastern District of Wisconsin no later than January 5, 2026. The lead plaintiff is a court-appointed representative for absent class members of the Class. You do not need to seek appointment as lead plaintiff to share in any Class recovery in the Class Action. If you are a Class member and there is a recovery for the Class, you can share in that recovery as an absent Class member.

If you wish to apply to be lead plaintiff, please contact attorney Mandeep S. Minhas at (888) 398-9312 or at [email protected].

What Can You Do?

You may contact an attorney to discuss your rights regarding the appointment of lead plaintiff or your interest in the Class Action. You may retain counsel of your choice to represent you in the Class Action.

CONTACT:

Mandeep S. Minhas

Scott+Scott Attorneys at Law LLP

230 Park Avenue, 24th Floor, New York, NY 10169

(888) 398-9312

[email protected]