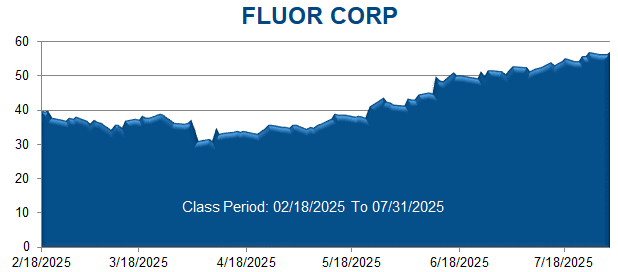

A securities class action has been filed against Fluor Corporation (FLR) on behalf of a class consisting of all persons and entities that purchased or otherwise acquired Fluor securities between February 18, 2025 through July 31, 2025. This case has been filed in the USDC – NDTX.

Fluor provides engineering, procurement, and construction (“EPC”), fabrication and modularization, and project management services worldwide. The Company operates through three segments: Urban Solutions, Energy Solutions, and Mission Solutions.

Throughout 2024 and the first quarter of 2025, Fluor’s Urban Solutions segment accounted for the largest portion of the Company’s revenue and profit. The Urban Solutions segment offers EPC and project management services to the advanced technologies and manufacturing, life sciences, mining and metals, and infrastructure industries, as well as provides professional staffing services. The Company’s infrastructure projects in this segment include work on, inter alia, the Gordie Howe International Bridge (“Gordie Howe”), as well as the Interstate 365 Lyndon B. Johnson (“I-635/LBJ”) and Interstate 35E (“I-35”) highways in Texas.

In February 2025, Fluor provided financial guidance for the full year (“FY”) of 2025, including adjusted EBITDA of $575 million to $675 million and adjusted earnings per share (“EPS”) of $2.25 per share to $2.75 per share. Defendants reaffirmed the foregoing financial guidance in May 2025, notwithstanding their acknowledgement of the potential negative impacts of ongoing economic uncertainty on Fluor’s business resulting from trade tensions and other market conditions. Contemporaneously, Defendants touted, inter alia, the purported health and stability of Fluor’s and its customers’ operations and the strength of the Company’s risk mitigation strategy, both for itself and its clients.

The Complaint alleges that, throughout the Class Period, Defendants made materially false and misleading statements regarding Fluor’s business, operations, and prospects. Specifically, Defendants made false and/or misleading statements and/or failed to disclose that: (i) costs associated with the Gordie Howe, I-635/LBJ, and I-35 projects were growing because of, inter alia, subcontractor design errors, price increases, and scheduling delays; (ii) the foregoing, as well as customer reduction in capital spending and client hesitation around economic uncertainty, was having, or was likely to have, a significant negative impact on the Company’s business and financial results; (iv) accordingly, Fluor’s financial guidance for FY 2025 was unreliable and/or unrealistic, the effectiveness of the Company’s risk mitigation strategy was overstated, and the impact of economic uncertainty on the Company’s business and financial results was understated; and (v) as a result, Defendants’ public statements were materially false and misleading at all relevant times.

On August 1, 2025, Fluor issued a press release reporting its financial results for the second quarter (“Q2”) of 2025. Among other results, the press release reported Q2 non-GAAP EPS of $0.43, missing consensus estimates by $0.13, and revenue of $3.98 billion, representing a 5.9% year-over-year decline and missing consensus estimates by $570 million. Defendants blamed these disappointing results on, inter alia, growing costs in multiple infrastructure projects due to subcontractor design errors, price increases, and scheduling delays, as well as reduced capital spending by customers. The same press release also provided a negatively revised financial outlook for FY 2025, guiding to adjusted EBITDA of $475 million to $525 million, down significantly from Defendants’ prior guidance of $575 million to $675 million, and adjusted EPS of $1.95 per share to $2.15 per share, down significantly from Defendants’ prior guidance of $2.25 per share to $2.75 per share, citing “client hesitation around economic uncertainty and its impact on new awards and project delays and results for the quarter[.]”

The same day, Fluor hosted a conference call with investors and analysts to discuss the Company’s Q2 2025 financial results. During that call, the Company’s Chief Executive Officer, Defendant James R. Breuer, disclosed that the infrastructure projects that had negatively impacted Fluor’s Q2 2025 results were the Gordie Howe, I-635/LBJ, and I-35 projects.

Following the foregoing disclosures, Fluor’s stock price fell $15.35 per share, or 27.04%, to close at $41.42 per share on August 1, 2025.