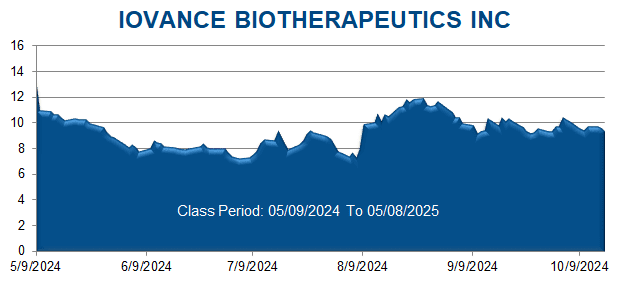

Scott+Scott Attorneys at Law LLP (“Scott+Scott”), an international shareholder and consumer rights litigation firm, alerts investors that a securities class action lawsuit has been filed in the United States District Court for the Northern District of California against Iovance Biotherapeutics, Inc. (“Iovance” or the “Company”) (NASDAQ: IOVA), and certain of its former and current officers and/or directors (collectively, “Defendants”). The Class Action asserts claims under §§10(b) and 20(a) of the Securities Exchange Act of 1934 (15 U.S.C. §§78j(b) and 78t(a)) and U.S. Securities and Exchange Commission Rule 10b-5 promulgated thereunder (17 C.F.R. §240.10b5) on behalf of all persons other than Defendants who purchased or otherwise acquired Iovance securities between May 9, 2024, and May 8, 2025, inclusive (the “Class Period”), and were damaged thereby (the “Class”). The Class Action is captioned: Farberov v. Iovance Therapeutics, Inc., et al., No. 3:25-cv-04199 (N.D. Cal.).

Iovance is a commercial-stage biopharmaceutical company that develops and commercializes cell therapies for the treatment of metastatic melanoma and other solid tumor cancers. The Company’s top priority is the commercialization of Amtagvi, a tumor-derived autologous T-cell immunotherapy used to treat adult patients with unresectable or metastatic melanoma. The Company received FDA approval for Amtagvi on February 16, 2024. The Company commercially launched Amtagvi on February 20, 2024.

The Class Action alleges that, during the Class Period, Defendants made false and/or misleading statements and/or failed to disclose that: (1) new Authorized Treatment Centers (“ATCs”) were experiencing longer timelines to begin treating patients with Amtagvi; (2) the Company’s sales team and new ATCs were ineffective in patient identification and patient selection for Amtagvi, leading to higher patient drop-offs; (3) the foregoing dynamics led to higher costs and lower revenue because ATCs could not keep pace with manufactured product; and (4) that, as a result of the foregoing, Defendants’ positive statements about the Company’s business, operations, and prospects were materially misleading and/or lacked a reasonable basis.

The truth began to emerge on May 8, 2025, after market hours, when the Company released its 1Q25 financial results, revealing a quarterly total product revenue of $49.3 million, a significant decline from the prior quarter’s $73.7 million. The Company also announced its FY25 total product revenue guidance had been slashed from between $450 million and $475 million to between $250 million and $300 million. The Company revealed it was “revising full-year 2025 revenue guidance to reflect recent launch dynamics” of Amtagvi. The Company further revealed “[t]he updated forecast considers experience with ATC [authorized treatment center] growth trajectories and treatment timelines for new ATCs.” On this news, the price of Iovance shares declined $1.42 per share, or 44.8%, to close at $1.75 per share on May 9, 2025, on unusually heavy trading volume.

If you purchased or otherwise acquired Iovance securities during the Class Period and were damaged thereby, you are a member of the “Class” and may be able to seek appointment as lead plaintiff.

If you wish to apply to be lead plaintiff, a motion on your behalf must be filed with the U.S. District Court for the Northern District of California no later than July 14, 2025. The lead plaintiff is a court-appointed representative for absent class members of the Class. You do not need to seek appointment as lead plaintiff to share in any Class recovery in the Class Action. If you are a Class member and there is a recovery for the Class, you can share in that recovery as an absent Class member.

If you wish to apply to be lead plaintiff, please contact attorney Nicholas Bruno at (888) 398-9312 or at [email protected].