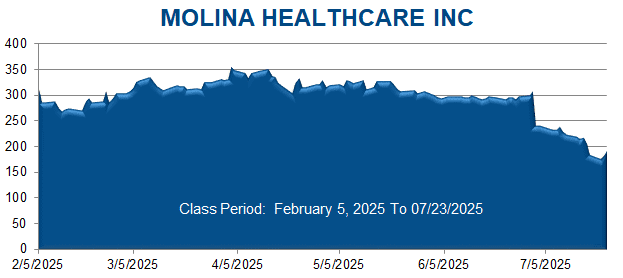

A securities class action has been filed against Molina Healthcare, Inc. (MOH) on behalf of persons and entities that purchased or otherwise acquired Molina Healthcare securities between February 5, 2025 through July 23, 2025. This case has been filed in the USDC – CDCA.

On July 7, 2025, before the market opened, Molina issued a press release announcing financial results for the second quarter of 2025 and slashing full year 2025 adjusted earnings per share guidance. The press release revealed the Company’s second quarter 2025 adjusted earnings of approximately $5.50 per share, which was “below its prior expectations” due to “medical cost pressures in all three lines of business.” The Company announced it “expects these medical cost pressures to continue into the second half of the year” and cut guidance for expected adjusted earnings per share 10.2% at the midpoint, from “at least $24.50 per share” to a “range of $21.50 to $22.50 per share.” The press release revealed Molina was experiencing a “short-term earnings pressure” from a “dislocation between premium rates and medical cost trend which has recently accelerated.”

On this news, Molina’s stock price fell $6.97, or 2.9%, to close at $232.61 per share on July 7, 2025, on unusually heavy trading volume.

The complaint filed in this class action alleges that throughout the Class Period, Defendants made materially false and/or misleading statements, as well as failed to disclose material adverse facts about the Company’s business, operations, and prospects. Specifically, Defendants failed to disclose to investors: (1) material, adverse facts concerning the Company’s “medical cost trend assumptions;” (2) that Molina was experiencing a “dislocation between premium rates and medical cost trend;” (3) that Molina’s near term growth was dependent on a lack of “utilization of behavioral health, pharmacy, and inpatient and outpatient services;” (4) as a result of the foregoing, Molina’s financial guidance for fiscal year 2025 was substantially likely to be cut; and (5) that, as a result of the foregoing, Defendants’ positive statements about the Company’s business, operations, and prospects were materially misleading and/or lacked a reasonable basis.