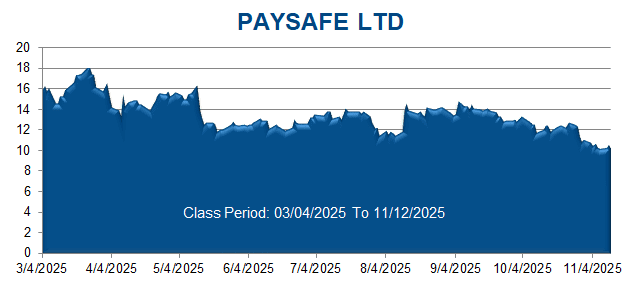

A securities class action has been filed against Paysafe Limited (PSFE) on behalf of persons and entities that purchased or otherwise acquired Paysafe securities between March 4, 2025 through November 12, 2025. This case has been filed in the USDC – SDNY.

Paysafe provides end-to-end payment solutions in the United States and internationally. The Company’s services allow consumers to purchase goods and services online without a bank account or credit card, or with alternative payment methods like cryptocurrencies. The Company maintains two reportable segments: Merchant Solutions and Digital Wallets. The Company’s Merchant Solutions segment represents services provided by processing credit and debit card transactions for merchants. The Company’s Digital Wallets segment represents the combination of its legacy alternative payment services and the sale of prepaid payment vouchers through other brands, sold directly to customers.

On November 13, 2025, before the market opened, Paysafe issued a press release announcing its financial condition and results of operations for the quarter ended September 30, 2025. The press release revealed the Company’s third quarter financial results, including revenue of $433.8 million, which missed consensus estimates by $5.8 million. The press release further revealed a net loss of $87.7 million, a steep drop from the prior year period wherein the Company’s net loss was only $12.98 million. The press release also disclosed a dramatic cut to the Company’s guidance, slashing full year 2025 expected revenue to $17 million at the midpoint, and adjusted EPS $0.50 at the midpoint.

On the same date, the Company filed its Condensed Consolidated Financial Statements as of September 30, 2025 on a Form 6-K with the SEC. The report revealed that the Company’s credit loss expense for the three months ended September 30, 2025 was $13,220 “primarily [as] the result of a specific provision for expected chargebacks related to an individual merchant in the Merchant Solutions segment.” The report further revealed write-offs for the three months ended September 30, 2025 was $9,924 “driven by the write off of irrecoverable amounts receivable in the Merchant Solutions segment.”

Finally, on the same date, the Company held an earnings call pursuant to these results. During the earnings call, the Company’s Chief Executive Officer, Bruce Lowthers (“Lowthers”) revealed the Company “had a last-minute client that had to shut down that caused several million-dollar write-down in Q3.” Lowthers further revealed the Company is “in kind of a lower-tier market, a lot of kind of travel or things that are more higher risk MCC [Merchant Category Codes] codes.” Lowthers explained “those things sometimes are a little difficult to bank” and “sometimes the banks aren’t open to the additional risk” “so, we’ve had a little bit of challenge with that with some of those MCC codes, and we’re working our way through that.”

On this news, Paysafe’s stock price fell $2.80, or 27.6%, to close at $7.36 per share on November 13, 2025, on unusually heavy trading volume.