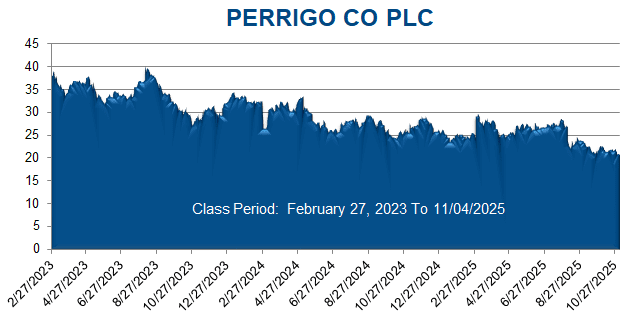

A securities class action has been filed against Perrigo Company plc PRGO) on behalf of persons and entities that purchased or otherwise acquired Perrigo securities between February 27, 2023 through November 4, 2025. This case has been filed in the USDC – SDNY.

In November 2022, Perrigo acquired Nestlé’s Gateway infant formula plant in Wisconsin, along with the U.S. and Canadian rights to Nestlé’s Good Start® infant formula brand, for $170 million.

On February 27, 2024, before the market opened, the Company reported fiscal year 2023 earnings, revealing significant acquisition and integration-related charges had to be taken, including an additional $35 million to $45 million for remediations to address production and facility issues in the infant formula business. Perrigo also disclosed a 50% decline in earnings per share compared to the prior year due to infant formula remediation actions. Nonetheless, the Company assured investors it anticipated the infant formula business stabilizing and returning to growth in the second half of the fiscal year.

On this news, the Company’s share price fell $4.87 or 15.14%, to close at $27.30 on February 27, 2024, on unusually heavy trading volume.

Then, on May 7, 2024, before the market opened, the Company released earnings for the first quarter ended March 30, 2024, revealing the significant negative impact of Perrigo’s costly actions to augment and strengthen the infant formula business, including that “net sales of $91 million decreased 34.5%” and the “gross margin of 36.5% declined 90 basis points.” Nonetheless, the Company assured investors “any planned large-scale manufacturing plant resets have been completed” and the cash costs in 2024 to achieve the remediation plan would stay flat at $35 to $45 million.

Then, on August 6, 2025, before the market opened, Perrigo announced earnings for the second quarter ended June 28, 2025, revealing “production issue led to scrapping of approximately $11 million of inventory.” Nevertheless, the Company’s Chief Financial Officer, Eduardo Bezerra assured investors that “[r]ecovery in our infant formula business is progressing.”

On this news, the Company’s share price fell $3.01 or 11.31%, to close at $23.61 on August 6, 2025, on unusually heavy trading volume.

Then, on November 5, 2025, before the market opened, Perrigo disclosed it “is initiating a strategic review of its infant formula business” and “reassessing the Company’s previously announced investment … of $240 million.” On the same day, the Company announced that “due primarily to infant formula industry dynamics,” Perrigo had slashed its fiscal year 2025 outlook. The Company cut its reported net sales growth guidance to -2.5% to -3%, a negative turn from the previously expected 0% to 3%. Further, the Company cut its expected adjusted diluted earnings per share to a range of $2.70 to $2.80, equating to a growth of 5% to 9%; a significant cut from the previously expected range of $2.90 to $3.10, equating to growth of 13% to 21%.

On this news, Perrigo’s stock price fell $5.09, or 25.2%, to close at $15.10 per share on November 5, 2025, on unusually heavy trading volume.