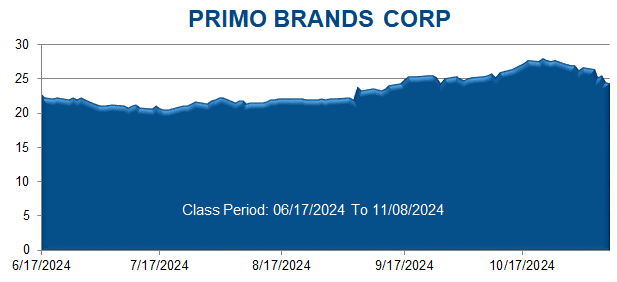

A securities class action has been filed against Primo Brands Corporation (PRMB) on behalf of all persons or entities who purchased or acquired (i) the common stock of Primo Water between June 17, 2024 through November 8, 2024. This case has been filed in the USDC – CT.

Primo Brands, formed following the November 8, 2024 merger between Primo Water and BlueTriton Brands, is a branded beverage company that offers beverage products across a variety of formats, channels, and price points.

The complaint alleges violations of Sections 10(b) and 20(a) of the Securities Exchange Act of 1934. Specifically, the lawsuit alleges that throughout the Class Period, Defendants misrepresented and failed to disclose key facts about the merger between Primo Water and BlueTriton Brands, including facts regarding the progress of the merger integration. Defendants issued a series of materially false and misleading statements that led investors to believe the merger would accelerate growth, generate transformative operational efficiencies, achieve meaningful synergies, and deliver strong financial results, and that the merger integration was proceeding “flawlessly.”

Investors began to learn the truth on August 7, 2025 when the Company announced its second quarter 2025 earnings, revealing that the merger had “led to disruptions in product supply, delivery, and service.” In response to this disclosure, the price of the Company’s common stock declined approximately 9%, from $26.41 per share on August 6, 2025 to $24.00 per share on August 7, 2025.

The truth was fully revealed on November 6, 2025, when the Company stunned investors by slashing its full year 2025 net sales and adjusted EBITDA guidance and announcing the replacement of CEO Rietbroek. During a conference call held that day, newly appointed CEO Eric Foss admitted that Primo Brands “probably moved too far too fast on some of the various integration work streams” and that “[t]here’s no doubt that speed impacted our ability to get through a lot of the warehouse closures and route realignment without disruption.” Foss further revealed “customer services issues” as well as “integration issues related to the technology move over.” On this news, the price of the Company’s common stock declined more than 36%, from a close of $22.66 per share on November 5, 2025, to close at $14.46 per share on November 7, 2025. From the Company’s Class Period stock price closing high of $35.63 per share on April 3, 2025, Primo Brands’ stock price dropped $21.17 per share, or nearly 60%, erasing billions of dollars from the Company’s market capitalization.