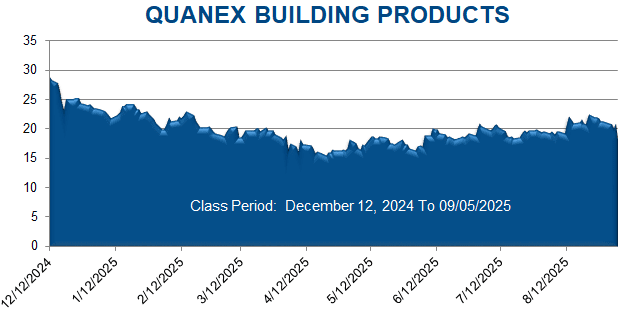

A securities class action has been filed against Quanex Building Products Corporation (NX) on behalf of persons and entities that purchased or otherwise acquired Quanex securities between December 12, 2024 through September 5, 2025. This case has been filed in the USDC – SDTX.

On September 4, 2025, after the market closed, Quanex announced financial results for the third quarter of the 2025 fiscal year. Among other things, the Company disclosed “operational issues related to the legacy Tyman window and door hardware business in Mexico that are ongoing” which “impacted results more than expected during the third quarter of 2025.” Specifically, the Company reported a diluted EPS of ($6.04), compared to $0.77 in the prior year period and an adjusted EBIDTA of $70.30. The Company further disclosed that it was “adjusting for lower expected volumes and pushing out the timing of when [it] expect[s] to realize procurement savings” from the integration of the Tyman business.

Then, on September 5, 2025, the Company held an earnings call pursuant to the Company’s third quarter 2025 financial results. During the earnings call, Chief Executive Officer, George Wilson (“Wilson”) explained “operational challenges” in the Tyman facility in Mexico “negatively impacted EBITDA in the Hardware Solutions segment by almost $5 million in the third quarter alone.” Wilson further explained that the issue was previously “identified midyear” as it got “deeper into the integration” with Tyman, and described how the systems used to “anticipate and plan for tooling repairs” were significantly deficient, indicating it was near “nonexistent.” Wilson stated because Quanex was “underinvested” in “the tooling condition and the equipment condition” it “had to make some changes and fix some things before it was catastrophic.”

On this news, Quanex’s stock price fell $2.73, or 13.1%, to close at $18.18 per share on September 5, 2025, on unusually heavy trading volume. The stock price continued to decline on the subsequent trading day, falling $1.98 or 10.9%, to close at $16.20 per share on September 8, 2025, on unusually heavy trading volume.