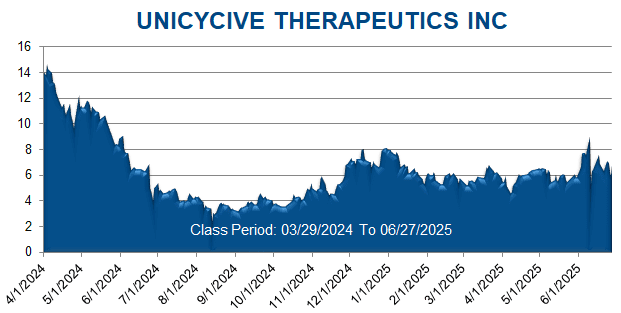

A securities class action has been filed against Unicycive Therapeutics, Inc. (UNCY) on behalf of a class consisting of all persons and entities other than Defendants that purchased or otherwise acquired Unicycive securities between March 29, 2024 through June 27, 2025. This case has been filed in the USDC – NDCA.

Unicycive is a clinical-stage biotechnology company that identifies, develops, and commercializes therapies to address unmet medical needs in the U.S. The Company is developing, among other therapies, oxylanthanum carbonate (“OLC”), a purported next-generation phosphate binder for the treatment of hyperphosphatemia in chronic kidney disease (“CKD”) patients on dialysis.

At all relevant times, Defendants consistently touted the prospects of a New Drug Application (“NDA”) for OLC for the treatment of hyperphosphatemia in CKD patients on dialysis (the “OLC NDA”), assuring investors and analysts of the Company’s readiness and ability to satisfy the U.S. Food and Drug Administration’s (“FDA”), inter alia, manufacturing compliance requirements.

In September 2024, Unicycive announced that it had submitted the OLC NDA to the FDA.

The Complaint alleges that, throughout the Class Period, Defendants made materially false and misleading statements regarding the Company’s business, operations, and compliance policies. Specifically, Defendants made false and/or misleading statements and/or failed to disclose that: (i)Unicycive’s readiness and ability to satisfy the FDA’s manufacturing compliance requirements was overstated; (ii) the OLC NDA’s regulatory prospects were likewise overstated; and (iii) as a result, Defendants’ public statements were materially false and misleading at all relevant times.

On June 10, 2025, Unicycive issued a press release “announcing an update on its [NDA] for [OLC] to treat hyperphosphatemia in patients with [CKD] on dialysis.” Therein, the Company disclosed that the FDA “had identified deficiencies in cGMP [current good manufacturing practice] compliance at a third-party manufacturing vendor”-specifically, a third-party subcontractor of Unicycive’s contract development and manufacturing organization (“CDMO”)-“following an FDA inspection” and that, “given the identified deficiencies, any label discussions between the FDA and the Company are precluded.”

On this news, Unicycive’s stock price fell $3.68 per share, or 40.89%, to close at $5.32 per share on June 10, 2025.

Then, on June 30, 2025, Unicycive issued a press release announcing that the FDA had issued a Complete Response Letter for the OLC NDA, citing the previously identified cGMP deficiencies at the third-party subcontractor of its CDMO.

On this news, Unicycive’s stock price fell $2.03 per share, or 29.85%, to close at $4.77 per share on June 30, 2025.