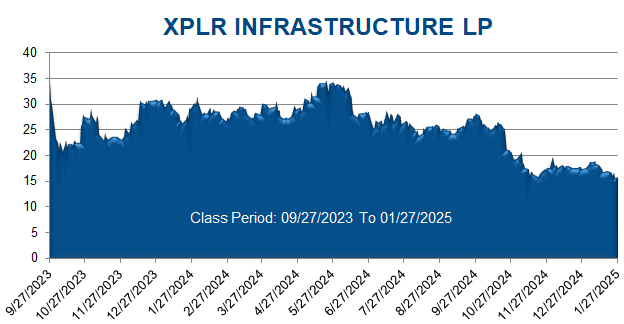

Scott+Scott Attorneys at Law LLP (“Scott+Scott”), an international shareholder and consumer rights litigation firm, has filed a securities class action lawsuit in the United States District Court for the Southern District of California against XPLR Infrastructure, LP f/k/a Nextera Energy Partners, LP (“XPLR” or the “Company”) (NYSE: XIFR), and certain of its former and current officers and/or directors (collectively, “Defendants”). The Class Action asserts claims under §§10(b) and 20(a) of the Securities Exchange Act of 1934 (15 U.S.C. §§78j(b) and 78t(a)) and U.S. Securities and Exchange Commission Rule 10b-5 promulgated thereunder (17 C.F.R. §240.10b 5) on behalf of all persons other than Defendants who purchased or otherwise acquired XPLR common units between September 27, 2023 and January 27, 2025, inclusive (the “Class Period”), and were damaged thereby (the “Class”). The Class Action filed by Scott+Scott is captioned: James Alvrus v. XPLR Infrastructure, LP f/k/a Nextera Energy Partners, LP, et al., Case No. 3:25-cv-01755.

XPLR acquires, owns, and manages contracted clean energy projects in the United States, including a portfolio of contracted wind and solar power projects, as well as a natural gas pipeline.

The Class Action alleges that, during the Class Period, Defendants made misleading statements and omissions regarding the Company’s business, financial condition, and prospects. Specifically, Defendants failed to warn investors that: (i) XPLR was struggling to maintain its operations as a yieldco (i.e., a business that owns and operates fully-built and operational power generating projects, focused on delivering large cash distributions to investors); (ii) Defendants temporarily relieved this issue by entering into certain financing arrangements while downplaying the attendant risks; (iii) XPLR could not resolve those financings before their maturity date without risking significant unitholder dilution; (iv) as a result, Defendants planned to halt cash distributions to investors and instead redirect those funds to, inter alia, resolve those financings; (v) as a result of all the foregoing, XPLR’s yieldco business model and distribution growth rate was unsustainable; and (vi) as a result, Defendants’ public statements were materially false and misleading at all relevant times.

The market began to learn the truth on January 28, 2025, when XPLR shocked investors by announcing that it would suspend entirely cash distributions to common unitholders and essentially abandon its yieldco model. Specifically, XPLR issued a press release announcing a “strategic respositioning” and stating that it was “moving from a business model that focused almost entirely on raising new capital to acquire assets while distributing substantially all of its excess cash flows to unitholders to a model in which XPLR Infrastructure utilizes retained operating cash flows to fund attractive investments.” In addition, XPLR announced that it had appointed a new CEO and CFO. On this news, the price of XPLR’s common units fell from a closing price of $15.80 per unit on January 27, 2025 to a closing price of $10.49 per unit on January 29, 2025—a decline of $5.31 per unit, or nearly 35%, trading on unusually high volume.

If you purchased or acquired XPLR common units during the Class Period and were damaged thereby, you are a member of the “Class” and may be able to seek appointment as lead plaintiff.

If you wish to apply to be lead plaintiff, a motion on your behalf must be filed with the U.S. District Court for the Southern District of California no later than September 8, 2025. The lead plaintiff is a court-appointed representative for absent class members of the Class. You do not need to seek appointment as lead plaintiff to share in any Class recovery in the Class Action. If you are a Class member and there is a recovery for the Class, you can share in that recovery as an absent Class member.

If you wish to apply to be lead plaintiff, please contact attorney Nicholas Bruno at (888) 398-9312 or at [email protected].