Scott+Scott Attorneys at Law LLP (“Scott+Scott”) is investigating whether ModivCare, Inc. (“ModivCare” or the “Company”) (NASDAQ: MODV), and certain of the Company’s senior executives, issued false and misleading statements or failed to disclose material information about ModivCare’s business. Specifically, whether the Company failed to disclose that its shared risk contracts failed to improve and normalize its cashflow.

ModivCare is a technology-enabled healthcare services company that provides a suite of integrated supportive care solutions, such as non-emergency medical transportation (“NEMT”), for public and private payors and their members. Between 2020 and mid-2022, a majority of the Company’s contracts with customers in its NEMT segment were “full risk contracts.” Full risk contracts required customers to pay the Company a fixed amount per eligible member per month. At the end of 2022, the Company began transitioning to “shared risk contracts,” which have provisions for reconciliations, risk corridors, and/or profit rebates.

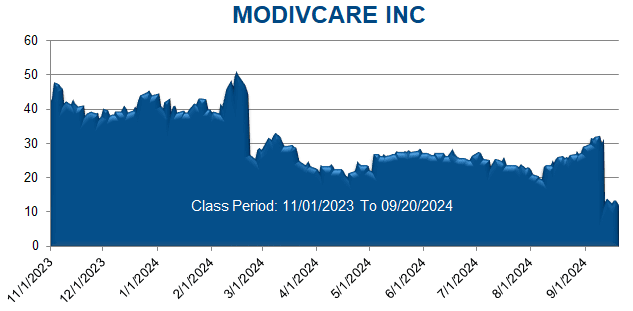

Scott+Scott’s investigation has revealed that, between November 3, 2023, and September 15, 2024 (“Class Period”), ModivCare mislead the market to believe that the

Company’s strong pipeline of newly negotiated shared-risk contracts materially mitigated the cash flow risks posed by a misbalance of its payables and receivables. For example, on November 3, 2023, during the earnings call associated with the release of the Company’s 3Q23 financial results, the CEO assured investors that the shared risk contracts would result in a “more normalized” balance between payables and receivables and “protect[] the downside to [the Company’s] cash flow.”

However, on February 23, 2024, during the earnings call associated with the release of the Company’s 4Q24 financial results, the Company revealed that free cash flow would be constrained during 1H24 due to the mismatch between payable and uncollected receivables. Nevertheless, the Company continued to assure investors that free cash flow would begin to normalize during 2H24 as a result of proactively working to renegotiate payment terms and switch contracts from full risk to shared risk. On this news, the Company’s stock price dropped $17.25, or nearly 39%, to close at $26.62.

Finally, on September 16, 2024, the Company issued a press release revising its 2024 Adjusted EBITDA guidance range from $185M–$195M to $170M–$180M, which it had issued just one month prior, on August 8, 2024, when it released its 2Q24 financial results. The Company attributed the revised guidance primarily to “NEMT segment pricing accommodations made to strategically retain and expand key customer relationships.” On this news, the Company’s stock price fell an additional $1.40, or nearly 10%, to close at $12.72.