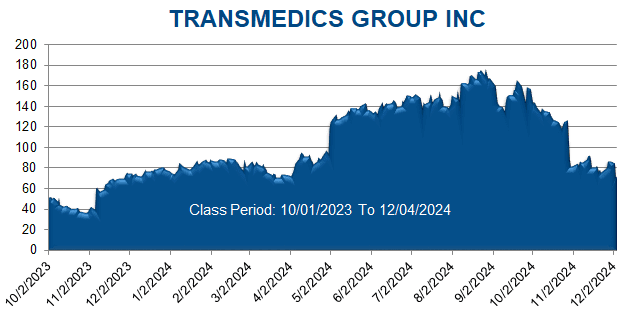

Scott+Scott Attorneys at Law LLP (“Scott+Scott”) is investigating whether TransMedics Group, Inc. (TMDX), and certain of the Company’s senior executives, conducted fraudulent billing schemes, off-label misuse of its devices, and reliance on kickbacks to drive sales. On December 2, 2024, TransMedics Group reduced its FY24 revenue guidance, which negatively impacted the Company’s stock price.

TransMedics Group operates an organ transplant ecosystem, under which it offers patented technology to preserve and mobilize organs; services that support transplant centers and medical teams; and a logistics arm that facilitates the entire chain. The Company not only owns a fleet of planes but uses third-party aircrafts to transport medical personnel to retrieve donor organs and deliver organs to patients for transplantation.

On October 28, 2024, the Company released its 3Q24 financial results. During the associated earnings call, the Company revealed that its revenue missed its estimates by a wide margin and that revenues were down sequentially. On this news, the Company’s stock price fell $39.24, or more than 30%, on October 29, 2024, trading on high trading volume.

After market hours on December 2, 2024, TransMedics Group issued a press release that revealed, among other things, additional information about the Company’s expected growth. Specifically, the Company narrowed its FY24 revenue guidance range by 2% at the midpoint. Following a dismal 3Q24—discussed in detail in Scott+Scott’s November 5, 2024, investigation alert—TransMedics Group’s new guidance implies a mere 35% sales growth rate for 4Q24, which is markedly lower than the triple-digit growth rates it delivered in 10 of its last 11 quarters. On this news, the Company’s stock fell $13.70, or more than 16%, to close at $71.44 per share on December 3, 2024, on unusually high trading volume.