Scott+Scott Attorneys at Law LLP (“Scott+Scott”), an international securities and consumer rights litigation firm, is investigating whether the leadership of Treace Medical Concepts, Inc. (TMCI) breached their fiduciary duties to Acadia Healthcare and its shareholders.

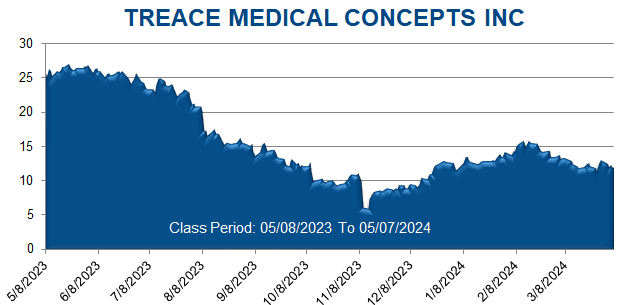

Treace’s flagship product is Lapiplasty, a patented surgical system that supposedly allows doctors to more easily treat bunions through Lapidus fusion surgery. From May 8, 2023, through May 7, 2024 (the “Class Period”), Treace touted the advantages of its Lapiplasty system versus traditional osteotomy surgery and assured investors that demand for Lapiplasty was strong. For example, on August 16, 2023, Treace’s CEO stated that he had not seen a competing technology “that can match Lapiplasty at the surgeon/patient interface yet” and that it would be “really hard” to compete with Treace, given its expertise in Lapidus fusion surgery. Similarly, on November 11, 2023, Treace’s CFO expressed confidence that the utilization rate and average selling price of Lapiplasty would increase and dismissed concerns about competition, stating that Treace was “way out ahead” and had “the best technology” and a “pretty powerful offense,” consisting of “rapid innovation” and its “direct sales channel,” through which it drives “patient advocacy.”

Notwithstanding Treace’s positive statements to investors about the demand for Lapiplasty and the minimal risk of competition, on May 7, 2024, Treace reported its results for the first quarter of 2024 and lowered its revenue outlook for 2024 from $220 to $225 million to $201 to $211 million, based on “quickly evolving” market conditions and the “increased use of” osteotomy surgery and “more competition from” competing Lapidus surgery solutions. Treace also disclosed that surgeon demand for Lapiplasty had decreased. Finally, Treace stunningly announced that it would enter the osteotomy surgery market—despite having marketed Lapiplasty as superior to osteotomy surgery. Following these disclosures, Treace’s stock plummeted 63% from $11.12 per share to $4.06 per share—a more than $7 per share loss.