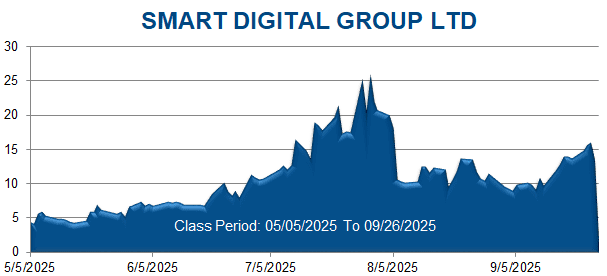

A securities class action has been filed against Smart Digital Group Limited (SDM) on behalf of persons and entities that purchased or otherwise acquired SDM securities between May 5, 2025 through September 26, 2025. This case has been filed in the USDC – SDNY.

Smart Digital conducts its purported business operations in Singapore, Macau, and Mainland China, through three operating entities: SMART DIGITAL META PTE. LTD., AOSI PRODUCTION CO., LTD., and Xiamen Liubenmu Culture Media Co., Ltd. The operating entities purportedly provide a broad range of services including: (1) event planning and execution services, which consist of drafting event planning proposals, customizing event marketing strategies, engaging event sponsors and other related services; (2) internet media services, which include developing marketing strategies, designing marketing content, distributing such marketing content on select internet platforms and other related services; (3) software customization and marketing services which enable customers to formulate and implement marketing activities through

The complaint alleges that hroughout the Class Period, Defendants made materially false and/or misleading statements and failed to disclose material adverse facts about the Company’s business, operations, and the true nature of the trading activity in the securities. Specifically, Defendants failed to disclose to investors that: (1) SDM was the subject of a market manipulation and fraudulent promotion scheme involving social-media based misinformation and impersonators posing as financial professionals; (2) insiders and/or affiliates used and/or intended to use offshore or nominee accounts to facilitate the coordinated dumping of shares during a price inflation campaign; (3) SDM’s public statements and risk disclosures omitted any mention of realized risk of fraudulent trading or market manipulation used to drive the Company’s stock price; (4) as a result, SDM securities were at unique risk of a sustained suspension in trading by either or both of the SEC and NASDAQ; and (5) as a result of the foregoing, Defendants’ positive statements about the Company’s business, operations and prospects were materially misleading and/or lacked a reasonable basis.