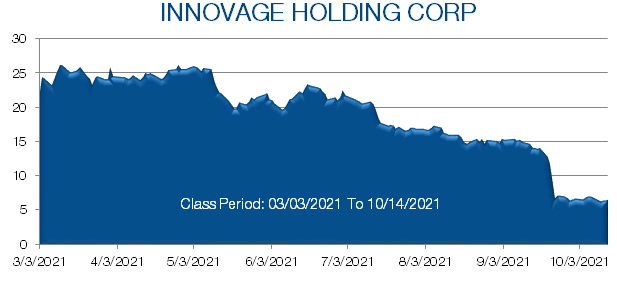

Scott+Scott Attorneys at Law LLP (“Scott+Scott”), an international shareholder and consumer rights litigation firm, reminds investors that securities class action lawsuits have been filed against InnovAge Holding Corp. (NASDAQ: INNV) (“InnovAge” or the “Company”) and certain other defendants, alleging violations of Securities Act of 1933. If you purchased shares of Innovage between May 17, 2021 through August 10, 2021, you are encouraged to contact for additional information at (888) 398-9312 or jzimmerman@scott-scott.com. The lead plaintiff deadline is December 13, 2021.

The lawsuit alleges that InnovAge and other insiders made false and misleading statements in the registration statement for the Company’s March 2021 initial public offering (“IPO”), which raised over $373.6 for the Company.

Specifically, the lawsuit alleges the registration statement omitted, that: (1) certain of InnovAge’s facilities failed to provide covered services, provide accessible and adequate services, manage participants’ medical situations, and oversee use of specialists; (2) as a result, the company was reasonably likely to be subject to regulatory scrutiny, including by the Centers for Medicare and Medicaid Services (CMS); and, (3) consequently, there was a significant risk that CMS would suspend new enrollments pending an audit of the company’s services.

On September 21, 2021, after the market closed, InnovAge held a conference call to discuss its quarterly earnings. On that call, InnovAge’s president and Chief Executive Officer, Maureen Hewitt, revealed that the Centers for Medicare and Medicaid Services had “determined to freeze new enrollments at [InnovAge’s] Sacramento center based on deficiencies detected in [a May 2021] audit.” Ms. Hewitt stated that these “deficiencies relate to failures to provide covered services, provide accessible and adequate services, manage participants’ medical situations, and oversee use of specialists, among others.”

On this news, InnovAge’s stock price fell $2.90 — nearly 25% — to close at $8.75 per share on September 22, 2021. As of the filing of the lawsuit, InnovAge traded at nearly 70% below the $21 IPO price.

Lead Plaintiff Deadline

The Lead Plaintiff deadline in this action is December 13, 2021. Any member of the proposed Class may seek to serve as Lead Plaintiff through counsel of their choice, or may choose to do nothing and remain a member of the proposed Class.

What You Can Do

If you purchased InnovAge stock, or if you have questions about this notice or your legal rights, you are encouraged to contact attorney Jonathan Zimmerman at (888) 398-9312 or jzimmerman@scott-scott.com.

About Scott+Scott

Scott+Scott has significant experience in prosecuting major securities, antitrust, and consumer rights actions throughout the United States. The firm represents pension funds, foundations, individuals, and other entities worldwide with offices in New York, London, Amsterdam, Connecticut, California, Virginia, and Ohio.

This may be considered Attorney Advertising.

CONTACT:

Jonathan Zimmerman

Scott+Scott Attorneys at Law LLP

230 Park Avenue, 17th Floor, New York, NY 10169

(888) 398-9312